Service \”Trade Analyzer\” by Amarkets

trader magazine is like a diary for personal entries, where all useful information about transactions is recorded. Why do you need a trading magazine? The trading magazine will discover the strengths and weaknesses of your trade and will allow:

not to jump from one system to another in search of the Grail (a magical win -win system that does not exist); Understand exactly what factors led to profit and which loss; know exactly what you follow your strategy without deviating from it; take into account the experience of previous transactions and determine, What technical figures bring you the right prognosis and good income, and which small traps of technical analysis, which are confusing all the time.

How to keep a trader diary?

The most obvious way-how to create a trader magazine-to record all your inputs and exits on transactions, profit, losses and other important information. Many experienced investors recommend determining three basic parts in the journal based on the stages of trade:

period to the transaction; transaction process (open position); Time after transactions.

If you do not record thoughts, forecasts, sudden insights and do not prepare for the market as a surgeon for surgery, that is, the risk of missing the obvious but important things for the final result simply because these things seem too ordinary and not worth attention.

in linking to your trading strategy Analyze the market and model future transactions before the start of trading or in weekends – if, for example, you can plan a long -term investor for many months and years to come. An example is so analytical Work for Forex can be formulated as follows (this is an abstract example and, of course, not a trading recommendation).

on the daily graph of EUR/USD at the moment in a confidently growing trend. The last 3 times the couple bounced off the MA (50) line. In the case of rollback to the MA (50), you can look for a model of a bullish candle and open a long position … and so on.

reference method of conducting analytical work for preparation for the transaction. Each trader formulates his thoughts and a preparatory algorithm for the most A comfortable model, based on personal preferences and personal vision. Trading installation – a reflection of a trade plan. You can a thesis of your thoughts, as concisely as possible in the Excel table.

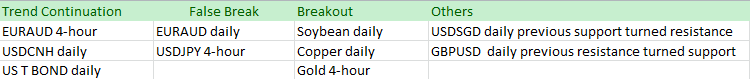

is a screenshot from the magazine of one trader-scalper, who marks in his diaries important metric for him. For example, the nature of the trend, as well as other characteristics that are key precisely for the personal trading strategy of a separate person: false breakdown, true breakdown and others Determining signals (for example, a situation when support became a resistance line … or when the resistance line turned into support).

Thus, the trader analyzes the market and brings the main technical points from the schedules to the journal. These moments are key in the framework of a separate trading strategy. For example, in this graphics, the price breaks below the previous support line and turns into a resistance line, which for a single trader is a trigger for entering the transaction.

And on this graph it can be seen that the price closed above the earlier intraday maximum. And for a single trader, this state of affairs is a signal for leaving the transaction:

in the above example of only four columns. You may have more. It all depends on your personal trading system, strategy and your personal preferences. If you have a small trade experience, then your diary should have all the information that is used to make a transaction. Even those details that seem You are granted.

we have already mentioned that people often forget, miss the obvious due to the apparent insignificance of the individual moment. In trading, distraction can be too expensive.

, for example, the following information may be in the trader’s diary:

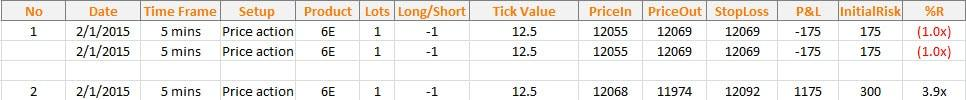

Date – the day when you go into the deal. Timeframe – Timframe. Setup – trigger (signal) for entering the transaction. Market is a market segment. LOT SIZE is the size of the lot. Long/Short is a long or short position. Price in – the price at which Come in. Price out – the price at which you close the position. Stop Loss – the price of your exit from the transaction in the event of an unsuccessful progress. Profit & Loss in $ – profit/loss. Initial Risk in $ is the amount you risk. R is the initial risk. Earned 2 times higher than the level of risk – earned 2R.

example of maintaining a trading journal in Excel (during the transaction and after):

How to work with a trader magazine to have an advantage over other market participants?

Have you learned to keep a trader diary? This is good. Now You need to learn how to correctly analyze what you bring into it …

for analytical work, you can use the following stages:

determine the patterns that lead to the profile. Determine the laws that lead to a loss. Find the ways to minimize losses. Find the ways to maximize profits.

The fact is that among your trading attitudes that seem normal to you, there may be some that make you incur periodic losses. The magazine of the trader It can help determine the “bad trigger” – a signal that you use, for example, as an incentive to enter the deal. Moreover, the position is most often unprofitable. Such a trigger must just stop using or modify the method of working with it.

is the same for “good triggers”. It is necessary to allocate templates from the general array that lead to profitable transactions. You can safely scale these templates and earn more.

to minimize losses, you will again need to filter your transactions and find patterns. It may well be that you will notice that on some days of the week you trade more successfully.

Trading habits and individual style bad habits of the trader

if you often face losses, even though you have a magazine, losses are the very first thing you should take on. The problem is most likely that emotions control your trade. It is important to start working systematically with bad trade habits, such as:

maintaining a loss -making position Contrary to common sense; too early entry into the deal with impatience; Sharp exits due to uncertainty in the success of the transaction, despite the fact that all indicators in order not to close the position yet.

in order to get rid of most bad trading habits that you have formed, experienced traders recommend withdrawing half of your deposit. Reducing your account doubles almost immediately reduces your attachment to money – this is how financial psychology works. What to do with the money that you withdrawn? Return Your funds back to the deposit slowly, as you seek sequence in your actions every month or quarter.

be sure to review your risk management system. Risk 1-2% of your account. If the level of your stop loss is achieved, you will lose no more than 1-2% of your account. Thus, you will know for sure that when you can lose, and if you are mistaken, your loss will not be at all critical.

to calculate the size of the position use the trader calculator. Question For a million – is it necessary to take risks 1% or 2% of the deposit in each transaction? It all depends on the trader himself. You may have, for example, $ 500,000 on a trading account with an intra -day trade and risk strategy of 0.25% for a transaction or $ 500 in an account for long -term positional trade with a risk of 5% for a deal.

The main algorithm, which helps to correlate the strategy, deposit size and the percentage of risk, is this:

The larger your trading account in relation to your own capital and/or lower timeframes you use When trading, the less you can risk in every transaction (less than 1%); The smaller your trading account in relation to your own capital and/or higher timeframes you use in trade, the more you can risk in every deal (more than 1%).

Diary of a trader and adjusting the trading strategy

If you are trying to make adjustments to your trading strategy, but your trading psychology fails, then no strategy in the world can help you. Thus, trading strategy – The last point in the journal of the trader (but not the last most important) that needs to be adjusted.

It is important to remember that your trading psychology and risk management problems are that your trading magazine may not see. It is important to deal with psychological mistakes (you need to strive for awareness and honesty in front of yourself), and then engage in global in the framework of your trade in a strategy.

Do you need a diary of a trader to a scalper?

can be said so – the magazine is more suitable Traders who sell at higher timeframes-from 15-minute candles and higher. Scalpers can write key indicators in the diary: entry point, trigger for entrance, daytime profits and losses …

Trading Analyzer

Where to keep the journal? In Google Tables or PC in Excel? Or download the free program from the Internet? In caring for their clients, Amarkets launched a free professional software analyzer, tied to a trader’s personal account. Software does not need to download, it is available In online mode, and all past data, of course, are preserved.

Service facilitates the diary and itself is the most comfortable and productive platform that analyzes all your trading data automatically. You do not need to make anything yourself: mark the levels, make screenshots of graphs, etc.

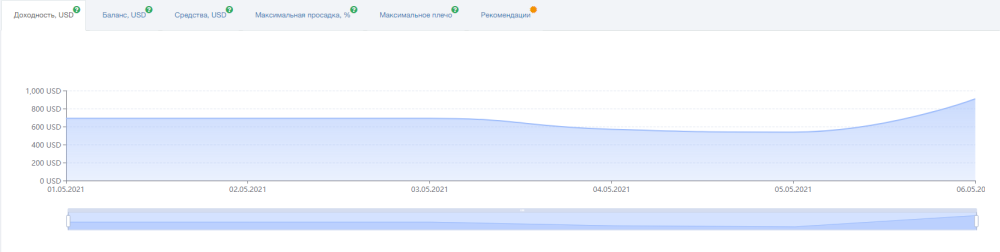

, the platform creates opportunities for analysis of profitability, balance, amount of funds, maximum subsidence and maximum shoulder – and for each of these indicators are displayed by a schedule displaying the progress of the trader.

In addition, Trade Analyzer helps to track the current state of the account in the online mode according to the most important parameters: it displays all the data on the current trading session in linking to the history of your previous operations. This is very cool! Because in every moment it helps to improve your trading process, making it more visual.

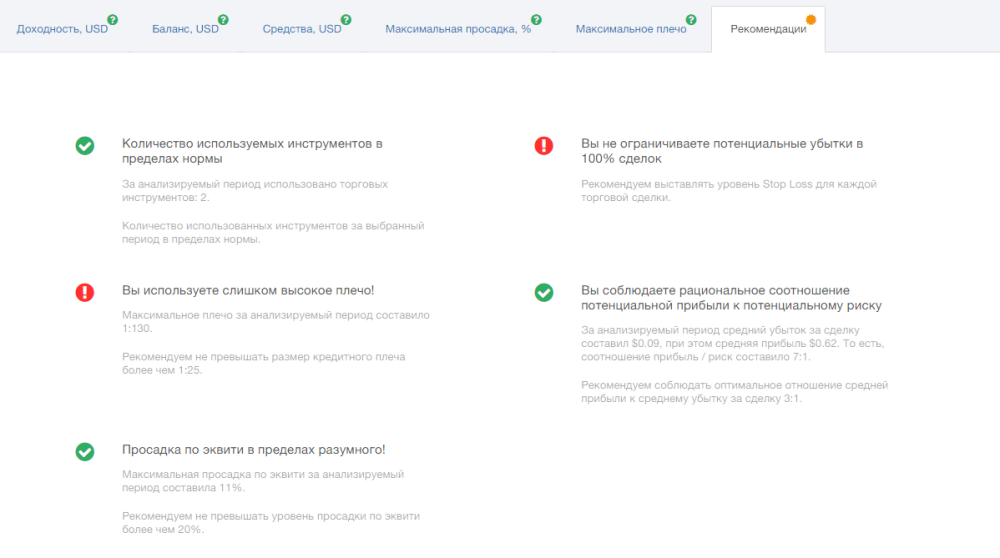

and, of course, the indisputable advantage of the trading analyzer is recommendations. Based on deposit history The platform generates tips on improving the trade process and the initial trading strategy.

Options for the recommendations of the trading analyzer

Recommended credit shoulder. The shoulder used by the trader is analyzed. Limiting potential losses. With frequent transactions without stopping, the service warns about potential losses. Analysis of the level of drawdown. Software recommends the level of permissible subsidence – indispensable assistance in risk management. Optimal number recommendations trading instruments. Recommendations on the ratio of profit to risk.

Personal Account and the trader magazine as part of a single interface is that it is easy to achieve with Amarkets broker!